ARES Smart Core Banking System

Ares Smart Core Banking System (ASCBS)

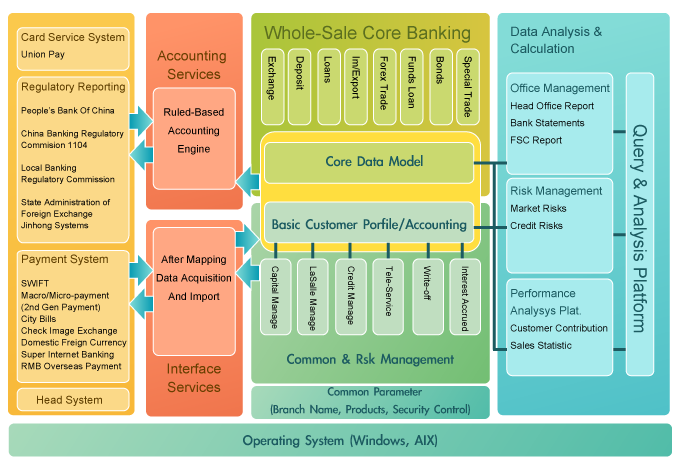

Ares Smart Core Banking System (ASCBS) includes a complete module, which satisfies Taiwan financial company extension needs in China. ASCBS provides accounting, sharing, deposit, loans, exchange, import, export, foreign exchange transaction, deposit fund lending, bonds, deposit with write-off, SWIFT, micro/macro-payment, city bill liquidation of domestic foreign currency clearing system and report user interface. Thus, this system allows a centralized or decentralized planning.

Taiwan-China Banks Foreign Exchange

- Foreign currency demand deposit

- Foreign currency deposit

- Foreign currency credit

- External remittance

- Internal remittance

- Daft collection

- Travelers check vending

- Import credit

- Export credit

- Warranties and guarantees

- Client currency exchange

- Proprietary foreign exchanging trading

- Funds transfer

- Funds deposit

- Money loans

- Bond trading

- Forfeiting

- Packing loan

- Import financing

- Export bills

- Order financing

- Discounting financing

- Factoring

Taiwan Banks-Chinese Yuan (RMB) Services

- RMB demand deposit

- RMB timed deposit

- RMB credit

- RMB import credit

- RMB export credit

- Entrusted collection

- Commitment collection

- Billing

- Financial services (deposit structured products)

- Trust linked debt funds

System Modules

- Accounting

- Sharing

- Saving

- Deposit

- Loan

- Exchange

- Import

- Export

- Foreign currency exchange

- Funds Deposit

- Bond

- Write-off

- Regulatory report interface

- User Interface

- SWIFT

- Macro/micro payment

- Local bill clearing

- Domestic/foreign currency clearing

Solution