ARES Treasury System

ARES Treasury System

To meet demands of Taiwan finance globalization and innovative financial products, Ares International Corp. is the first company that introduces a Straight through Processing (STP) treasury system. With global financial market changes and regulation of Financial Supervisory Commission (SFC), it is more important to provide service that complies with need for various financial products.

Ares innovates a new generation of treasury system that complies with the current need in the financial industry basing on more than 35-year experience in research and development for financial information system. Functions contain major financial products such as domestic and foreign exchange rate as well as interest rate, bond, derivatives to provide the best choice to stay more competitive and earn more benefit with less efforts in the financial industry.

Helpful Trading Tool for Finance and Accounting

Ares, the first company in providing a STP financial system, has developed a treasury system covering domestic and foreign exchange rate as well as interest rate of financial trading.

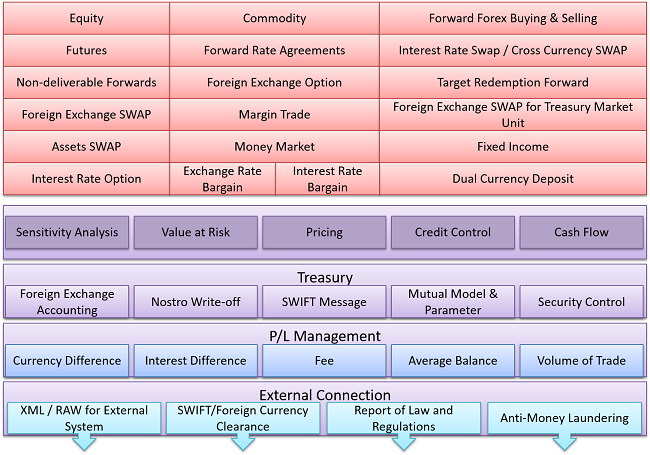

Treasury system structure

Features

Foreign Exchange

Money Market

Fixed Income

FX Derivatives

Interest Rate Derivatives

Market Risk Management / Pricing

Regulation Compliance

G/L Accounting

P/L Analysis

TMU

Benefits

- Confirmation letter auto-generated

- Reduce manpower cost and lower risk with automation

- Real-time evaluation provided and ensure trading price is reasonable

- Adjustment of automation rules with features of new product

- Function of risk disclosure

- Enhancement of market risk management for derivatives

- Intuitive operation without learning special language programming

- Fast understanding with graphs

- Accelerate promotion for new product such as structured product, European KI Value option

- Generate document in Chinese such as instruction, trading confirmation letter, and so on

- Immediate product calculation after graphic breakdown such as evaluation, value at risk, sensitivity

- Complete integration with front-end operation

- Capacity for corresponding product for registration

- Self-define expiration (expiration date) of profit-and-loss model

- Graphic auto-record breakdown logic. No manpower need and operation of importing to back-end operation

- Support various derivatives

- Self-configuration on return model

- Model designed replying on volatility and risk factors

- Evaluation model designed across products

- Anticipate volatility smiling curves from market price

- Full consideration to use model in market

- Open and transparent evaluation model

- Real test and use

- Local support

- Simplify financial product

- Simplify evaluation

- Market material cost reduction

- High-frequency (monthly/quarterly/yearly) evaluation and high manpower cost are solved

- Evaluation team is unnecessary (including evaluated tool, manpower, market material, and so on)

- Solution for limitation of audit that depends on experts opioion

Product comparison

Customers